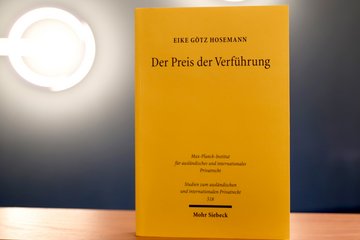

Consumer credit reform in Japan – taking stock ten years on

Over the first decade of the millennium, Japan's consumer credit system underwent fundamental and radical change as a consequence of intensive regulation, extensive adjudication, and targeted law enforcement. Numerous measures for borrower protection have been adopted, which almost led to the collapse of the consumer credit market. In this process, credit law has become a highly controversial legal issue, a central subject of judicial practice, and one of the most dynamic topics in Japanese law.

Julius Weitzdörfer examines the multi-faceted nature of Japan’s new credit laws, across all domains of civil, criminal, and administrative law, and taking into account their institutional background. With the benefit of hindsight, it emerges that so far the reforms have neither led to a catastrophic credit crunch, nor to a ballooning black market, disproving cautionary voices fiercely opposing the bill.

In comprehensively analysing the causes and consequences of, as well as the responses to criminal behaviour associated with granting, securing, and collecting loans from both a socio-legal and a law-and-economics perspective, his work fills a final research gap regarding the financial market reforms initiated in Japan since the onset of crisis three decades ago. Moreover, his findings allow legal lessons from Japan to be incorporated into the global discussions on re-regulating consumer credit in the wake of the last financial crisis. In sum, Weitzdörfer paints an empirically rich portrait of Japanese civil, criminal and supervisory law until the end of the Heisei period.

Julius Weitzdörfer, Verbraucherkreditregulierung in Japan [Regulating Consumer Credit in Japan] (Studien zum ausländischen und internationalen Privatrecht 435), Mohr Siebeck, Tübingen 2020, Dissertation Universität Hamburg 2018, XX, 440 pages.