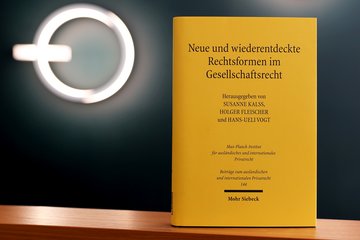

Corporate Governance by Management and Supervisory Boards

Individuals at the helm of a German company are bound by a large number of rules that are prescribed in various legal instruments. In addition to the Commercial Code (HGB), these include in particular the Securities Trading Act (WpHG), the German Securities Acquisition and Takeover Act (WpÜG), the Stock Corporation Act (AktG), and subordinate legislation such as the German Corporate Governance Code (DCGK). A handbook co-edited by Klaus J. Hopt, Director Emeritus at the Institute, presents this complex network of standards as an integrated corporate governance framework regulating stock corporation law, capital market law and accounting law.

The 50 thematic articles in this volume deal with core issues, current challenges, and the future direction of corporate governance in respect of capital market oriented companies. The stock corporation remains the central figure in this highly dynamic legal milieu, and it is an institution that indeed affects all other forms of companies. Stock company law, for example, increasingly spills over into other areas, with the result that limited liability companies and other corporate entities face increasing requirements for compliance and risk management systems under supervisory law.

With contributions written by renowned authors from the fields of German corporate law and corporate practice, this work is aimed at legal scholars and legal practitioners alike. It offers guidance on a wide range of issues, such as how to deal with corporate risks, conflicts between the expectations of different investors, and the exercise of entrepreneurial discretion in the face of legal requirements and compliance management.

“In today’s corporate practice, it is no longer sufficient to focus solely on the minimum legal obligations in terms of duties and conduct,” says Hopt. “One need consider only the extensive reporting obligations on corporate governance and the growing international expectations of companies.” As described by the legal scholar, not only company managers but also their internal and external advisors are required to be mindful of conduct recommendations even before they are firmly established and to take precautions as necessary. Hopt explains that code of conduct recommendations, supervisory authority expectations, and mere transparency rules will often later solidify into general obligations under company law; we thus find an “emergence of duties risk” that is not given enough attention. Accordingly, topics such as the German Corporate Governance Code and the prerequisites set by institutional investors and proxy advisors are also covered in the handbook.

Prof. Dr. Dr. Dr. h.c. mult. Klaus J. Hopt, MCJ (NYU) was Director at the Institute from 1995 to 2008. Before that time, he held professorial posts in Tübingen, Florence, Bern, and Munich. Guest professorships led him to Paris, Vienna, Rome, Tokyo, Kyoto, Chicago, New York University, Harvard, and Columbia University in New York. He is a member of the German National Academy of Sciences and the International Academy of Comparative Law and has authored numerous publications on business and entrepreneurial law as well as on the topic of corporate governance. He has served as a consultant for the European Commission, international banks, the German legislature, and German Federal Constitutional Court.

Peter Hommelhoff, Klaus Hopt, Patrick C. Leyens (eds.), Unternehmensführung durch Vorstand und Aufsichtsrat. Aktien-, Kapitalmarkt- und Bilanzrecht, Corporate Governance, C.H.Beck, München 2024, XXII, 1339 pp.

Image: © Max Planck Institute for Comparative and International Private Law